Summary:

- Around 42% of UK adults (that’s roughly 22.6 million people) have used Buy-Now-Pay-Later (BNPL) services.

- The UK BNPL market is expected to reach about £28.69 billion (€34 bn) in 2025 and grow through the late 2020s.

- Over 50% of Gen Z and Millennial consumers in the UK have used a BNPL option in the last year (2024) to manage their spending.

- However, new FCA regulations are set to tighten the market. From mid‑2026, even small loans under £50 will be preceded by affordability checks, clearer terms, and ombudsman access for borrowers.

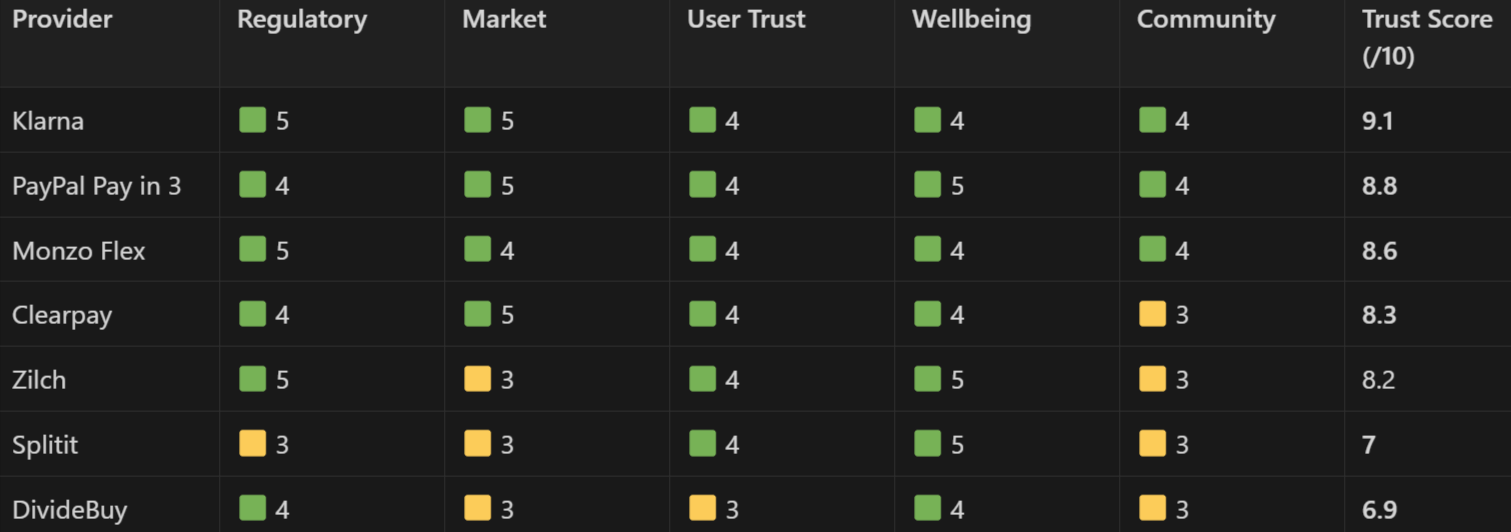

- Our UKNB Trust Score evaluates the UK’s top BNPL providers on regulation, transparency, user experience, consumer protection and reputation, to help you find services that are both smart and safe.

Buy Now Pay Later In The UK: Pros, Cons, and the New FCA Rules

Buy Now Pay Later (BNPL) has quickly become a regular fixture in UK shopping—from high-street retailers to online checkouts.

With buy now pay later apps in the UK, you can split your payments over weeks or months, often at zero interest if you follow the repayment schedule.

BNPL is now a common feature in online shopping. If you want to know more about the tech shaping online retail, see our article on technology trends shaping the future of online shopping.

But for many, what seems simple on the surface can come with pitfalls and surprises.

Buy Now Pay Later: Pros and Cons

Here’s what you need to know about buy now pay later pros and cons:

The Pros:

- No up-front cost: Make a purchase today and pay it off gradually, even if you don’t have the cash right now.

- Usually interest-free: As long as you pay on time, you typically pay nothing extra.

- Fast and flexible: Get approved in seconds; use buy now pay later apps in the UK at checkout—online or in store.

The Cons:

- Encourages impulse buys: The ease of spreading payments means it’s tempting to spend more than planned.

- Late fees add up: Miss a payment and you could face unexpected charges—some providers cap these, others don’t.

- Potential impact on credit: Increasingly, your payment record with BNPL apps may affect your credit file, making missed payments more serious.

With these risks, it’s clear why new rules are on the way.

Why is the Financial Conduct Authority (FCA) stepping in—and what’s changing?

For years, many BNPL plans have escaped full regulation—leaving shoppers with less protection and more risk of building up debt. From May 2026, the Financial Conduct Authority (FCA) will enforce new rules:

- Stricter affordability checks: Even small loans will require proof you can afford repayments.

- Clearer terms: All fees and repayment schedules must be made crystal clear.

- Real help for those who struggle: BNPL firms will be required to support customers who fall behind, instead of just adding more charges.

To make it easy for you to choose the right buy now pay later service in the UK, we have analysed all providers and selected the top 6.

How We Selected Our Top 6 Buy Now Pay Later Apps Available In The UK

We rate each BNPL provider on five important factors:

- Regulation & Compliance (30%) – Is the provider fully regulated, transparent, and proactive with new FCA rules?

- UK Reach & Reputation (25%) – How widely is it used and trusted across the UK?

- User Feedback (20%) – What do real customers say about their experience; are ratings and reviews positive?

- Consumer Wellbeing (15%) – Does it offer clear terms, fair fees, and real help for anyone who struggles?

- Track Record (10%) – Has it shown reliability and responsibility over time?

Each factor is scored out of 5, weighted by importance, and combined for a UKNB Trust Score out of 10.

It’s the quickest way to see which buy now pay later apps in the UK really put customers first.

Top 6 Buy Now Pay Later Apps In The UK

1. Klarna – UKNB Trust Score: 9.1/10

Klarna is the UK’s most popular BNPL app, offering interest-free Pay in 3 or 30 days, plus long-term financing options. Klarna stands out for its sheer scale, slick app, and early adoption of FCA compliance.

- Parent Company: Klarna Bank AB (Sweden)

- BNPL Offer/Terms: Pay in 30 days; or split your purchase into three interest-free, automatic payments

- App Name: Klarna (iOS/Android)

- UK Reach: ~10M+ users

- Regulation: FCA e-money licence, prepping for full FCA BNPL rules in 2026

2. PayPal Pay in 3 – UKNB Trust Score: 8.8/10

PayPal Pay in 3 is available everywhere PayPal is accepted, splitting purchases into three interest-free payments. Notable for zero late fees and integration with PayPal’s trusted payment system.

- Parent Company: PayPal Holdings Inc. (US)

- BNPL Offer/Terms: Split purchases into three interest-free instalments, with the first due at the time of purchase and the next two paid monthly

- App Name: PayPal (iOS/Android)

- UK Reach: Universal across major merchants

- Regulation: FCA-authorised company; Pay in 3 not yet under full credit regulation

3. Monzo Flex – UKNB Trust Score: 8.6/10

Monzo Flex is the BNPL product of Monzo – A digital bank. Allows customers to split any purchase over £100 into three interest-free payments, or longer terms with interest.

- Parent Company: Monzo Bank Ltd (UK)

- BNPL Offer/Terms: Pay in 3 months (0%), or 6–24 months with interest

- App Name: Monzo (iOS/Android)

- UK Reach: 9M+ Monzo users

- Regulation: FCA-authorised as a bank, full credit regulation

4. Clearpay – UKNB Trust Score: 8.3/10

Clearpay lets shoppers pay in four interest-free fortnightly instalments. Loved for easy checkout and top high street brands, it’s a leader in the UK BNPL market, though some smaller merchants are not on board.

- Parent Company: Block, Inc. (US)

- BNPL Offer/Terms: Pay for purchases in four instalments over six weeks, with payments automatically deducted every two weeks and no interest

- App Name: Clearpay (iOS/Android)

- UK Reach: Estimates range around 4 to 5 million UK users

- Regulation: FCA registered, contracts updated under FCA review

5. Zilch – UKNB Trust Score: 8.2/10

Zilch offers an ad-subsidised model: Pay Now (cashback) or Pay Over 6 Weeks, always interest-free. Stands out for reporting positive payments to credit agencies and having FCA full authorisation.

- Parent Company: Zilch Technology Ltd

- BNPL Offer/Terms: Pay in instalments, with a 25% upfront payment followed by three further 25% payments every two weeks

- App Name: Zilch (iOS/Android)

- UK Reach:5M+ users, 5,000+ merchants

- Regulation: Fully FCA-authorised, reports to credit bureaus

6. Splitit – UKNB Trust Score: 7/10

Splitit splits payments using your existing credit card (up to 12 instalments) without charging interest or new fees—handy for those with available credit but not wanting new debt.

- Parent Company: Splitit Inc. (US)

- BNPL Offer/Terms: Up to 12 instalments, no fees/interest, uses your own credit card

- App Name: None (retailer checkout)

- UK Reach: Currys, Sofology, Harvey Nichols, etc.

- Regulation: Not a lender; operates outside standard BNPL regulation

Use this guide to compare BNPL providers confidently—especially now that regulation is catching up. Choose only those with both strong protections and clear, fair terms. When in doubt, check your eligibility and repayment plan carefully.

Frequently Asked Questions

Are all buy now pay later apps in the UK regulated and safe to use?

Not all buy now pay later apps in the UK are currently regulated, but new FCA rules will soon require tougher checks and clearer terms. Well-known brands like Klarna, Clearpay, and Monzo Flex already follow high standards and are working to meet upcoming regulations. Always check terms and pick trusted providers with clear support options.

Will using buy now, pay later apps in the UK affect my credit score?

It depends. Some buy now pay later apps in the UK, like Zilch and Klarna, now report your payment behaviour to credit reference agencies. Paying on time can help your credit history, but missing payments may hurt your score. Always check what each app reports before you sign up.

What should I look out for before choosing a buy now, pay later app in the UK?

Before signing up, compare the app’s late fee policy, payment terms, and how easy it is to get help if something goes wrong. Look for providers with strong reviews, transparent fees, and FCA authorisation or registration. The best buy now pay later apps in the UK make it easy to track what you owe and help you avoid falling behind.